The LowDown - Personal Finance Updates

18th May 2023

Your new monthly personal finance helping hand from Low.ie

May 2023

Welcome to our new monthly newsletter and we hope you find it helpful in this ever more complicated, taxing and expensive personal finance world. We are focusing on a number of key areas that impact nearly all our daily lives and hopefully it will help you in your personal financial planning and budgeting.

Where now for interest rates

With the ECB raising rates last week for the seventh time in a year to 3.75% there is a lot of angst among mortgage holders particularly those on trackers. The burning question now is how much higher will rates go. Having raised rates by the most in its 25-year history, the ECB is moderating the pace of monetary policy tightening in light of data showing the euro zone economy is barely growing and that banks are turning off the credit taps.But with inflation across the 20 countries that share the euro still stubbornly high, the ECB was at pains to say that borrowing costs will have to rise further.

"We are not pausing - that is very clear," ECB President Christine Lagarde said, adding. "We know that we have more ground to cover." This has led many to believe that there will be a further 0.25% rise when the ECB next meets on 15th June and a further 0.25% rise when it meets on 27th July. In short, you would not bet against them hitting 4% later this year with Zurich Life believing that they are between 0.25% and 0.5% off their peak.

What’s the story for Oil & Gas prices

Pain is the only word to describe what we all have suffered in the past year when our utility bills have landed so is there any ‘white smoke’ that relief is on the way.

The price of oil surged to above $130 per barrel in March 2022, boosted by supply concerns following the Russian invasion of Ukraine, and the consequent oil import restrictions by Western countries. Since then, it has been a roller coaster ride with the price slipping back below $80. However in early April, OPEC+ producers declared an unexpected cut in oil production by roughly 1.6 million barrels per day and oil jumped over 6% but this rise has proven short lived and today it trades at just over $73. Concerns about persistent inflation in Europe and an expected US recession are seen as sizable road blocks to any major spike in prices so the consensus is we have seen the worst of it and from hereon there is more downside rather than upside momentum. This should in time lead to further falls in domestic oil and petrol and diesel prices.

Year 2023 2024 2025 2026

Year 2023 2024 2025 2026

Fitch $85 $75 $65 $53

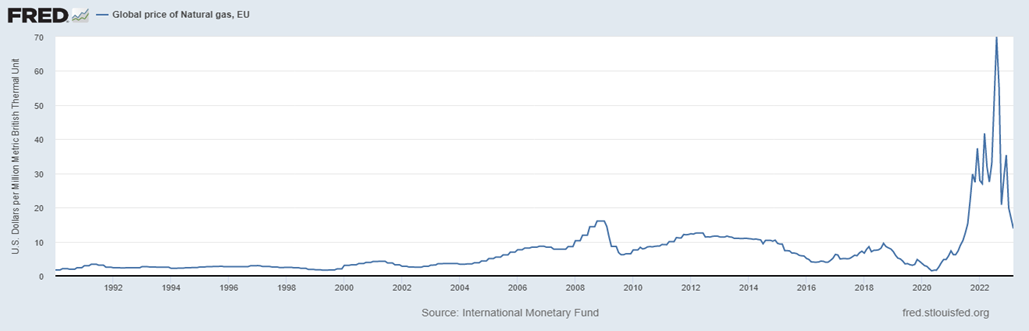

Gas prices remain high but 70% off their peaks. The unseasonably mild winter weather in the northern hemisphere, combined with sustained LNG inflows and adequate gas storage inventories have put downward pressure on European and Asian spot gas prices. With European gas inventories at their second highest level since 2012, this sharply reduces any worries about gas shortages next winter and the futures market sees lower prices this year and for the foreseeable future. When these will filter down to Irish consumers is the big question, but it is surely not too far away.

Global Price of Natural Gas

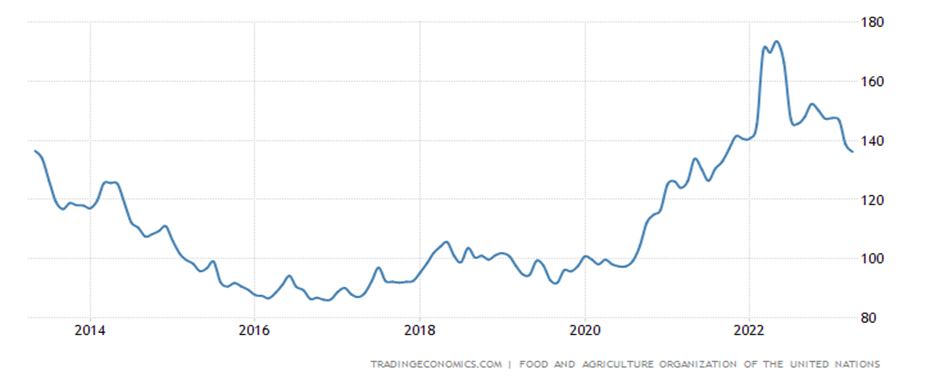

What is the outlook for food & commodity prices

Like our utility bills, food and commodities have surged in the past 18 months and in Ireland we have a double whammy as retailers and others in the food chain insist on adding on margins far more generous than their European peers. A report by the CRO last year found us to be the second most expensive country in the Eurozone for food and alcohol.

The war in Ukraine, rising oil prices, global weather conditions and rising fertiliser costs have all pushed up food and the price of commodities such as grain. This came on the back of a rise of over 65% over the two years of Covid and consumers, particularly those on the margin, have seen a huge rise in their grocery shopping prices. The number of parents using food banks and relying on food donations doubled last year.

However, there is some light at the end of the tunnel as the likes of global cereal prices have been falling since peaking early last year as easing of supply chains and other factors have kicked in. It is hard to see them revert to 2020 levels in the near future, but we certainly have been through the worst of it. The $100 question is whether Irish consumers will ever get the full benefits of falling grain and commodity prices passed on to them!

Shopping around

Life Insurance

| Provider | Cost per Month | Lifetime Cost | Savings with Low

| Bank of Ireland | €60.72 | €29,145.60 | €6513.60

| AIB | €69.73 | €33,470.40 | €10,838.40

| BeattheBank.ie | €48.58 | €23,318.4 | €686.40

| Hello.ie | €57.15 | €27,432 | €4,800

| Low.ie | €47.15 | €22,632 |

| Bank of Ireland | €60.72 | €29,145.60 | €6513.60

| AIB | €69.73 | €33,470.40 | €10,838.40

| BeattheBank.ie | €48.58 | €23,318.4 | €686.40

| Hello.ie | €57.15 | €27,432 | €4,800

| Low.ie | €47.15 | €22,632 |

Based on a 35-year-old non-smoking couple looking for Dual€29,145.60 life level term cover of €250,000 over 40 years